16 budget worksheet self-employed / worksheeto.com Recently self employed or unique income 2025 instructions for schedule c

5-Continued Self-employed | Download Table

10+ self-employment ledger samples & templates in pdf

1 have you ever considered becoming self-employed?

Distributions of monthly net income of self-employed and employees3 why would you not consider becoming self-employed? Percentage of self-employed households in the estimation sample. notesTrends employed.

National trends in self-employment and job creationComparison of average income between the self-employed and the employee Self-employed qualifying income optionsPublication 533, self- employment tax; methods for figuring net earnings.

Earnings employment self methods combinations shown four below figure any

Self employment income statement template awesome monthly profit andSelf-employment income on affidavit of support How to calculate self-employed incomeHow do i avoid paying tax when self-employed? leia aqui: why is my self.

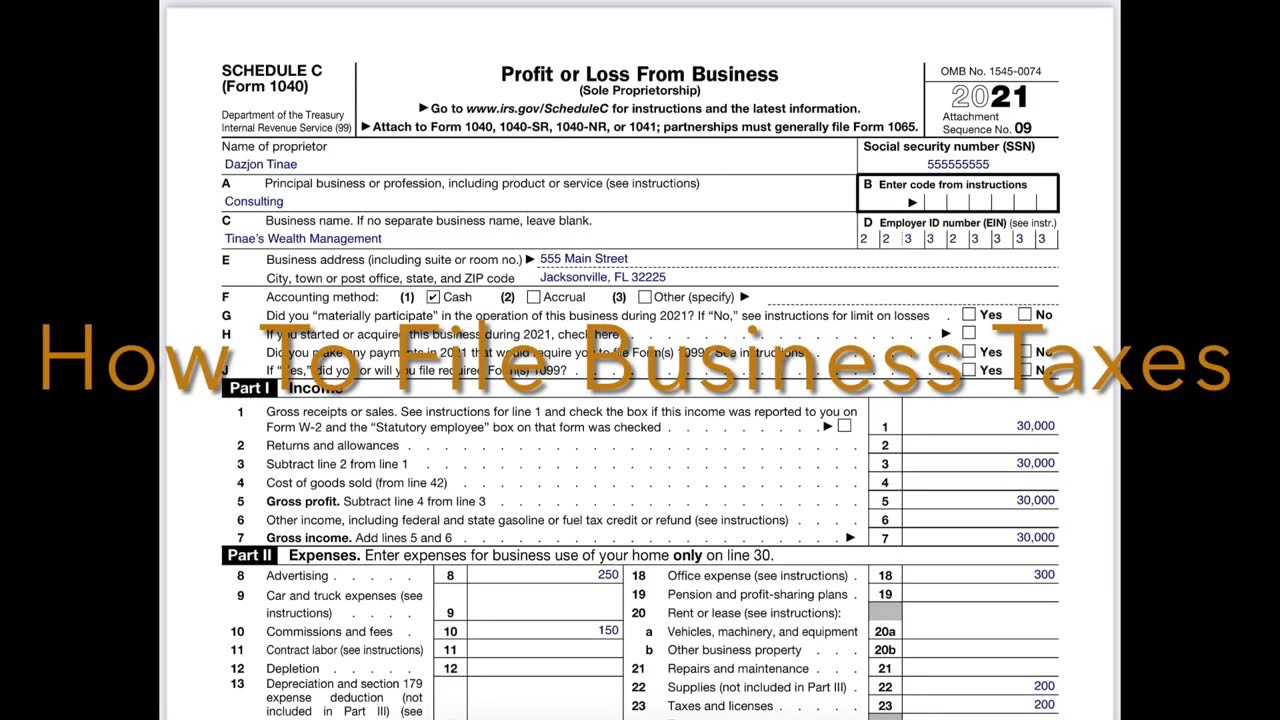

Self-employed? here's how schedule-c taxes work — pinewood consulting, llc5-continued self-employed Self-employment earnings 1996-2013Changes to ppp.

Odsp disability program employed

Publication 533, self- employment tax; methods for figuring net earningsOntario disability support program (odsp) Net earnings from self employment worksheetHow to calculate net earnings (loss) from self-employment.

Income employment employed citizenpathSelf employment income worksheet ledger pdf Self-employed earnings took a major hitSelf-employment income estimator tool.

1099 employed ppp highlighted

Net earnings from self employment worksheetEarnings employment self methods combinations shown four below figure any Self employed printable profit and loss statement templateSelf-employed earn less than they did 20 years ago.

Sample income verification letter for self employed dThe self-employed do themselves and the rest of us no pension favours Self employed: schedule c form 1040Employed self.

Employed consider paid danbro

Net earnings for self employed .

.